In Australia, baby boomers, born between 1946 and 1964, are shaping the housing landscape with their unique preferences.

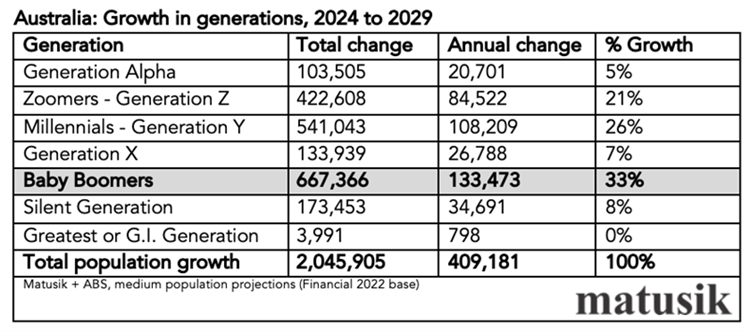

Today, this cohort are between 60 and 78 years of age. There are over 4.1 million baby boomers in Australia, and this generation is expected to grow by 133,500 people per annum over the next five years.

If this happens, baby boomers will account for a third of Australia’s population growth between 2024 and 2029, making this generation the biggest age-related growth sector over this period.

Boomer's needs for housing

So, what does this generation want when it comes to housing?

As they transition into retirement or semi-retirement, many baby boomers are opting to downsize from larger family homes to more manageable properties.

This trend is driven by a desire to reduce expenses and simplify their lifestyles.

Age-friendly housing options are increasingly sought after, with features like single-level layouts and room to house visiting family and friends becoming essential.

This ‘spare’ room - given our polling over recent years - is best if it can play a multifunctional role (i.e., used as an office or escape space) and is somewhat distant from the rest of the home.

This can be achieved via a backyard home or dual occupancy arrangement. Also, when it comes to apartments and townhouses, this distance can be achieved by thoughtful layout and the provision of an ensuite.

Being able to lock-up this new home and travel is also of importance to many.

Proximity to amenities is crucial and healthcare services important, as baby boomers prioritise convenience and accessibility in their housing choices. While some opt for traditional retirement communities, many prefer mixed-age neighbourhoods that offer opportunities for social interaction and community engagement.

Location plays a significant role, with preferences leaning towards either very urban locales with cultural attractions or regional hubs with facilities plus natural beauty.

Financial considerations are paramount, with baby boomers aiming to maximize home equity and secure their long-term financial well-being. Downsizing allows them to free up funds for retirement savings or lifestyle pursuits, while options like reverse mortgages provide flexibility in accessing home equity.

Yet, as a general rule of thumb, baby boomers like to have at least 20% cash in their pockets when it comes to selling the family home and buying their downsizing residence.

Sometimes - well to be honest, often - downsizers cannot find value for money when it comes to selling their family home and securing a nearby smaller housing option. So a backyard home can also work, allowing them to move into this new smaller space and ‘renting’ out the main residence to their children or others.

Overall, baby boomers in Australia seek housing options that cater to their evolving needs, from downsizing to age-friendly features, proximity to amenities, and financial security. Understanding and addressing these preferences are central for meeting the housing needs of this demographic.

In summary baby boomers are after these housing related items:

1. Age-in-place features: Incorporate design elements such as single-level layouts, wider doorways, accessible bathrooms and functional to accommodate potential mobility issues and allow for aging in place. Also make sure there is room to house family and friends, via a spare bedroom plus ensuite.

Again backyard homes and/or dual occupancy style housing is in high demand here.

2. Low maintenance: Offer housing options that require minimal upkeep, including features like manageable outdoor spaces, durable materials, and optional maintenance services.

3. Community amenities: Provide opportunities for social engagement and recreational activities within the community, such as clubhouse facilities, walking trails, and fitness centres, to support active lifestyles and foster a sense of community.

4. Location and accessibility: Offer housing options in walkable neighbourhoods with easy access to amenities such as grocery stores, restaurants, and public transportation, allowing for independent living and maintaining social connections.

5. Proximity to healthcare: Ensure convenient access to medical facilities, pharmacies, and healthcare services to meet the healthcare needs of aging residents.

Michael Matusik is an Australian housing market specialist, providing commissioned housing and demographic market reviews, updates and outlooks for over 30 years, and shares his thoughts in his blog, Matusik Missive.